Financial Planning Through Real People

We're not your typical financial planners. Most of us started out struggling with our own budgets before we figured out what actually works.

Our Approach to Financial Guidance

Financial calendar planning shouldn't feel like decoding tax law. We started caatasarilia in 2022 because traditional financial advice always seemed disconnected from real life. Bills don't wait for month-end, expenses overlap, and income timing matters more than most planners admit.

Our team includes former teachers, retail managers, and small business owners who learned financial planning the hard way. That diversity shapes how we think about calendar-based money management. We've been the person checking their account balance before buying groceries, so we understand the practical side of timing expenses.

What makes our approach different is honestly pretty simple. We focus on when money moves, not just how much. Traditional budgeting tools treat every month the same, but your February spending looks nothing like your December spending.

What Guides Our Work

These aren't mission statement buzzwords. They're the principles we actually use when helping clients build better financial calendars.

Timing Over Totals

Most budgets fail because they ignore when expenses hit. We help clients map their actual cash flow patterns across the year, which often reveals opportunities they've missed.

Real Scenarios Only

We don't create perfect theoretical budgets. Every planning example comes from actual client situations we've worked through, including the messy parts that generic advice skips.

Adjustable Systems

Life changes, and financial plans need to flex with it. We build calendar systems that clients can modify themselves without starting over or calling us for every adjustment.

No Judgment Approach

Starting your financial planning journey at 45 instead of 25 doesn't make you behind. Different timelines work for different people, and we adapt our methods to where clients actually are.

Pattern Recognition

After helping hundreds of clients, we've spotted recurring timing issues that traditional budgeting misses. Sharing those patterns helps people avoid common calendar planning mistakes.

Transparent Limitations

Calendar planning helps with timing and organization. It won't fix income problems or eliminate necessary expenses, and we're clear about what our approach can and can't do.

The People Behind caatasarilia

Small team, diverse backgrounds, shared focus on practical financial calendar planning.

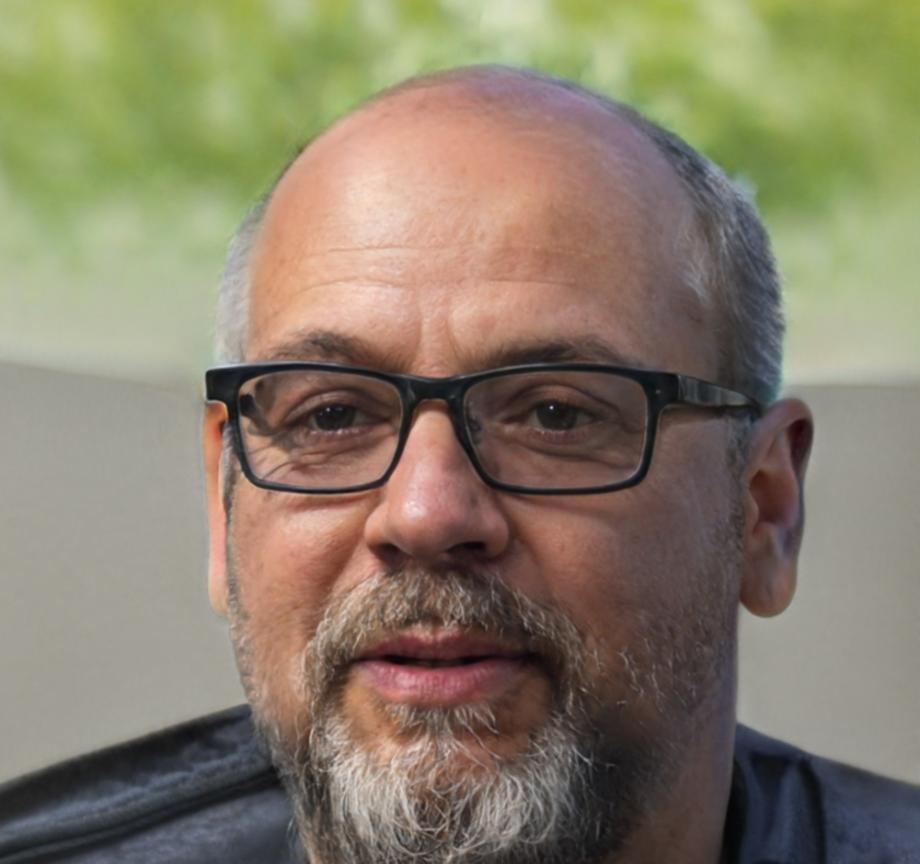

Callum Vesterberg

Founder & Lead PlannerStarted caatasarilia after spending six years as a high school math teacher in Halifax. Watched too many colleagues struggle with biweekly paychecks and irregular expenses, which got me thinking about calendar-based approaches to budgeting.

My background is actually in statistics, not finance. That analytical mindset helps when we're mapping out complex income and expense patterns for clients. I spent 2023 building our core planning methodology, testing it with about 40 families before we officially launched.

Outside of work, I'm usually hiking somewhere around Cape Breton or trying to keep my vegetable garden alive despite Nova Scotia's unpredictable weather.

Silje Markström

Client Systems CoordinatorJoined caatasarilia in early 2024 after running a small bookkeeping business for local contractors. That experience showed me how much timing matters in cash flow management, especially for people with variable income streams.

I handle the systems side of our planning work. When clients need help setting up their financial calendars or adjusting existing plans, I'm usually the person they work with. My job involves a lot of troubleshooting and finding workarounds for unique situations that don't fit standard templates.

Before bookkeeping, I managed inventory for a retail chain, which taught me more about planning cycles than any finance course could have. Those patterns show up everywhere once you start looking for them.

Anders Fjellström

Planning AnalystMy background is in data analysis for a manufacturing company, where I spent years optimizing production schedules. Turns out those same timing principles apply surprisingly well to personal finance when you think about cash flow as a scheduling problem.

I came on board in mid-2024 to help develop our analysis tools and work with clients who have complex financial situations. Think multiple income sources, irregular billing cycles, or business owners mixing personal and business expenses.

The pattern recognition skills from my previous work transfer directly to financial calendar planning. Most people's money problems aren't about math—they're about timing mismatches that compound over time.

How Calendar Planning Changes Things

Real examples from client situations we've worked through, showing what calendar-based financial planning actually looks like in practice.

Variable Summer Cash Flow

A teacher couple came to us frustrated because summer always felt financially tight despite decent salaries. Traditional budgeting advice told them to "save more," which wasn't particularly helpful.

We mapped their actual pay schedule against their expense calendar. Turns out they were getting 10 months of paychecks spread over 12 months of bills, but their previous budget treated every month identically.

After reorganizing their payment timing and building a visual calendar, they stopped feeling surprised by summer expenses and could plan their annual spending more realistically.

Irregular Payment Patterns

A graphic designer working with multiple clients never knew when invoices would actually get paid. Some clients paid in 15 days, others took 60-plus days. Her monthly budget was basically a guess.

We built a calendar system tracking her actual payment histories by client, which revealed clear patterns she could plan around. Instead of hoping for consistent monthly income, she scheduled her bills based on realistic payment windows.

She now knows which expenses to schedule around her faster-paying clients and which to delay until slower payments typically arrive. Less stress, fewer overdrafts.

Rotating Income Timing

A healthcare worker with rotating shifts got paid biweekly, but the paychecks landed on different calendar dates each cycle. Her bills were monthly, creating constant timing conflicts she couldn't predict.

We created a rolling 90-day calendar that mapped her pay dates against her bills for the next three months. This gave her a clear view of which pay periods were tight and which had buffer room.

Instead of reacting to timing problems as they happened, she could see them coming and adjust discretionary spending accordingly. Small shift in approach, significant reduction in financial stress.

Mixed Personal-Business Expenses

A contractor struggled to separate business cash flow from personal finances. His income varied seasonally, and he never knew how much he could safely pull from business accounts for personal use.

We built dual calendars—one tracking business cash flow patterns over the previous two years, another mapping his personal expense cycles. This revealed his business had predictable busy and slow seasons he wasn't fully utilizing.

He now plans larger personal expenses around his predictable busy seasons and keeps a tighter budget during known slow periods. His business account stays healthier, and he's not guessing about personal draws.